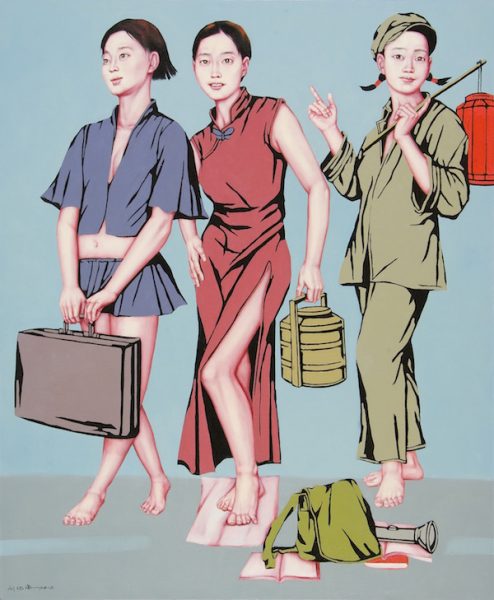

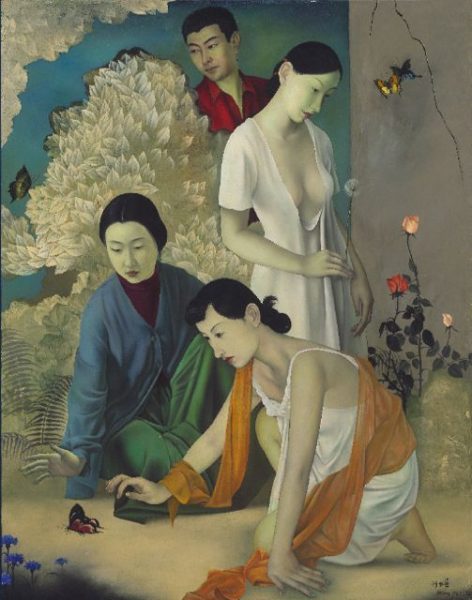

The contemporary fine art world is a smaller place these days. In 2016, Cai Guo-Qiang, a Chinese artist living and working in New York City, organised What About the Art? – an exhibition featuring the works of 15 Chinese contemporary artists – in Doha, Qatar. Such is the increasingly international element of today’s art market, as robust private wealth and capital flows facilitate the growth of the global art landscape. Dealers with outposts in multiple cities, jet-setting art connoisseurs with collections spread among homes in various locales, private museums exhibiting a cross-border section of the arts and museums sponsored by international donors have become the norm.

The burgeoning appetite of emerging wealth has also fuelled a growing interest in art acquisition, propelled by the potential of art as an investment vehicle, in addition to growing one’s social quotient. Regulatory and commercial issues then come into play, more so when creative funding solutions are proposed to take advantage of the skyrocketing value of established art.

At the same time, established wealth look to grow their involvement in the art world, through the support of emerging artists or international engagement with museums the world over. Among others, intellectual property and tax considerations factor heavily into these activities.

Emerging trends pose fresh considerations for stakeholders. In 2015, the online art market accounted for US$4.7 billion in trade, giving rise to tax issues in characterisation and attribution of income, and legal issues relating to the import-export market. Multilateral approaches to legislation necessitate an equivalent international planning response. An increasingly globalised market, even as cities clamour to be the next art hub, underscores the need for careful cross-border tax and wealth planning for the sophisticated collector, and can mean innovative solutions for the gallery owner or art dealer.

Singapore’s status as a transit hub creates a fertile ground for building connections and nurturing relationships with artists, collectors, curators, critics and art academics. The growth of international art fairs and the establishment of art galleries have inspired and engaged a new generation of collectors.

Art is an attractive asset to consider when one is looking to diversify one’s investment portfolio. The low, or lack of, correlation of art to other asset classes positions it as a great hedging option in turbulent economic times. It should be noted that Singapore does not have a capital gains tax, and abolished estate duty in 2008. Collectors who decide to use their collection as collateral should ensure that loan terms are not overtly draconian; skilful negotiation should be sought where a lender seeks possession of the artwork prior to a full repayment being made.

Collecting for the next generation

Establishing a private art foundation or museum is a flexible way to grow and showcase one’s collection while preserving its inherent investment value through generations. This organization can take the form of a trust or company, to which the collector transfers title to pieces from his private collection, whether at one go or over a period of time. The trustees or governing board of the organization may comprise the collector, family members and a trusted team of art historians or advisers, who understand intimately the collector’s philosophy and can steer the collection in the desired direction. The organization may then act as the central touch point in acquiring, loaning or consigning artworks, as well as in obtaining appraisals and organising public education initiatives centred on the collection, thereby adding to its provenance.

In Singapore, companies that donate artworks or artefacts to approved museums are eligible for a 250 per cent tax deduction on the value of the artwork or artefact. An organization that is also a registered charity in Singapore will enjoy exemption from income tax. Loaning imported artwork to museums may also enjoy an exemption from the payment of import Goods and Services Tax.

An art foundation or museum can also be an incredibly agile tool in succession planning. If the family of the collector lacks the same passion or knowledge needed to maintain the private collection, the collection may be gifted over to the organization upon the passing of the founding collector, while being shielded from the reach of opportunistic buyers or any creditors of the family.

Additionally, the foundation or museum will have the ability to keep intact the integrity of the collection as a whole, instead of having pieces dispersed among various beneficiaries. Appropriate records of each artwork will also go far in preventing inadvertent garage sales of art by clueless beneficiaries at far below its market value. In certain jurisdictions, such a provision may also greatly reduce the estate duty levied on the collector’s estate.

As the art world embraces the complexity of global mobility, harmonising the various wide-ranging and intricate legal issues involved – intellectual property, tax, immigration, dispute resolution and succession planning – is more crucial than ever. The global art market is also not immune from the international push towards greater transparency; the opaque transactional world of art is likely to be in for additional regulation or self-regulation in the coming years. The well-advised artist, dealer or collector is nevertheless poised to navigate the changing tides of the global art market.

*extracted from the business times website