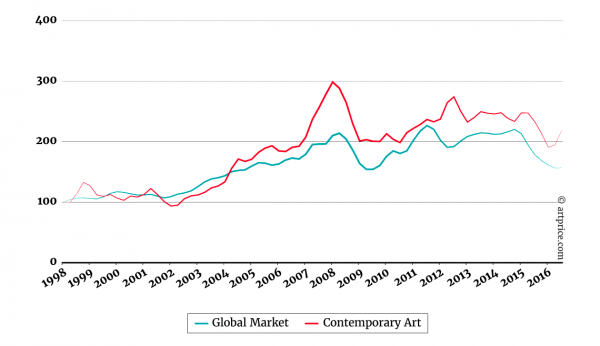

The severe economic and financial crisis that has engulfed the entire planet since 2007, with almost ubiquitous negative interest rates as its most recent expression, has made the art market look like an oasis in the desert. Yes… it has shown signs of correction over the past year, but this was both necessary and foreseeable in a market whose most visible segment, Contemporary art, is also its most volatile.

Between July 2015 and June 2016 the Contemporary art segment generated a global auction turnover of $1.5 billion compared with $2.1 billion in the previous 12-month period. That’s a contraction of more than a quarter; but the long-term trend is still massively positive, with an increase of +1,370% since 2000.

Moreover, the correction would appear to have finished. In fact, now that the art market is an “efficient” market (thanks notably to Artprice), the major auction operators immediately reacted to the contraction by adjusting their offer as of H2 2015… and the first signs of a recovery are already visible.

Contemporary art on the front line

After four years of uninterrupted growth, turnover on the Contemporary art segment posted a sharp contraction in the first half of 2015. The movement continued in the second half of the year with the year’s turnover total down -39% versus the previous year. Nevertheless, as this report shows, the various corrections on prices, transaction volumes and individual artists’ price levels confirm the art market has reached a much higher level of economic maturity compared with the 1990s when economic turbulence had a deeper and more chaotic impact. By comparison, today’s dynamic and “smart” Contemporary art market looks like a different world altogether.

After the extraordinary results between July 2013 and June 2014 – the most prosperous period in the Contemporary art market’s history in terms of annual turnover, volumes exchanged and auction records – some sort of market restructuring was almost inevitable. The market’s effervescence saw a lot of profit-taking coupled with an intensification of demand for relatively young signatures.

Towards a recovery

Although Contemporary art is still sensitive to the worst economic troughs, it rapidly regains its vitality. In the first semester of 2016, the segment posted a milder contraction (-14%) than the rest of the art market.

After 12 months of shrinkage, the Contemporary art market adapted perfectly to the new environment with the major auctioneers quickly introducing their “plan B”. This involves dropping their habitual race towards new records and focusing their offer on the lower end of the high-end spectrum and the “middle market”. This change is most obvious in the restructuring of their sales: results above $50,000 have represented 6% of the lots sold compared with 8% during the previous 12-month period.

The strategy adopted by the major auction operators has been effective. The modification of their offer has allowed a stabilisation of prices, as indicated by the improvement in the market’s price index.

In the long term, demand remains strong, international and discriminating, driven by highly-connected collectors who are permanently informed of market realities and acutely aware of the latest trends. Despite certain hesitations, Contemporary art buyers have pursued their buying and selling and seem to have perfectly adapted to the current economic context.

For over ten years now the Contemporary art segment has been the art market’s second most profitable segment with its prices rising nearly as fast as the Post-War segment (artists born between 1920 and 1944). Prices in the Post-War segment have literally rocketed in the context of London and New York’s dominance of the global secondary art market.

However, the Contemporary art market has demonstrated an unprecedented level of economic maturity. Based on past experience of previous crises, the major auctioneers have shown their capacity to restrict supply in order to protect existing price levels. This strategy has allowed a stabilisation of prices within a matter of months, while transactions volumes have remained high and unsold rates have remained stable.

The success of this strategy not only avoids a more protracted downturn; it also significantly contributes to making Contemporary art a high-performance long-term asset. Over the last 16 years the segment has posted an average annual yield of 4.9% while its auction turnover has grown 1,370% and its global transaction volumes have quadrupled.

Collecting Contemporary art involves supporting artists whose price structures are still under construction and whose offer (the number of works in circulation) is likely to evolve. This makes the prices in the Contemporary art segment more volatile than for the artworks in previous artistic periods, which in turns makes the segment the most attractive in the Art Market. Sudden surges in prices explain the fascination of collectors for this market.

Price explosions are usually due to two complementary phenomena: the emergence of new artists and the elevation of big names to the rank of art market icons. The risk of market contractions and periodical price adjustments has not (and does not) slow the growth in the number of art collectors.

Given these macro and micro-economic realities, the Art Market, particularly over the past 18 years, can be considered a safe haven in the face of economic and financial turbulence, generating substantial and recurring yields. At a time when Central Banks are effectively practicing negative interest rates that are literally destroying the population’s savings, the art market is showing insolent health with its Contemporary segment showing a 1,370% increase in annual turnover over 16 years. The result is a strong linear progression of the average value of a Contemporary artwork by 115% over the same period, i.e. an average annual return of +4.9% that even reached +9% for works purchased above the $20,000 threshold.

Long-term growth

Fortunately, the Contemporary art market remains a profitable investment over the medium and long term. Despite various adjustments, the price index shows that the sector has maintained the vitality it acquired in the early 2000s. Its turnover growth of +1,370% in 16 years speaks for itself.

*extracted from ‘The Contemporary Art Market Report 2016’ by artprice