Major cities, especially in Asia such as Hong Kong, Shanghai, Beijing, are investing heavily in the arts and culture, building new museums and hosting exhibitions. That’s encouraging a new generation of art lovers and greater contemporary art awareness.

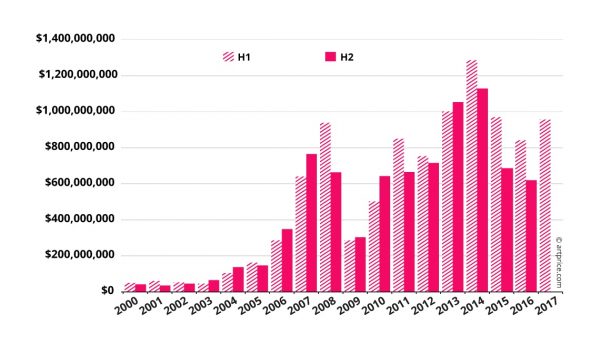

Sales of Contemporary Art became apparent in the first half of 2017 with a +14% growth in global auction turnover signalling a new period of prosperity.

Rising prices

For the period from July 2016 to end-June 2017, Contemporary Art generated a global auction turnover of $1.58 billion, i.e. +3.2% over the same year-earlier period. At the same time, the number of lots sold contracted by -2%: 57,100 artworks sold versus 58,400 the previous year. Lastly, the global unsold rate has remained perfectly stable at 41%.

An increase in turnover on fewer transactions means the prices of the works on offer were generally higher. The average price for a work of Contemporary Art has risen from $26,160 to 27,600. The median price this year is around $1,300.

The rise of Contemporary Art is essentially focused on four major cities. New York, London, Hong Kong and Beijing alone account for 83% of global Contemporary Art auction turnover.

Generally speaking, the Art Market’s concentration on the world’s major financial capitals is intensifying with Contemporary Art. Primarily focused on the Market’s high end, this concentration has the advantage of forcing collectors to compete with each other, attracting the best supply of artworks and the best demand from buyers.

It is true that masterpieces by Old Masters are becoming increasingly rare on the Market as they are absorbed into museum collections. However, this does not explain why collectors are increasingly turning towards Contemporary Art, and, by all accounts, with considerable passion. Contemporary Art is the most exhilarating segment of today’s Art Market primarily because it receives almost all the attention, is an extraordinary vector for social recognition and each work harbours an enormous financial potential.

A virtuous circle

Michael Govan, director of the Los Angeles County Museum of Art (LACMA), explains the domination of Contemporary Art in museum programmes as a consequence of museums trying to avoid being dominated by white male artists: “If your mission is to reflect the world, and that women are half of this world… it’s a lot easier if you are working in the present” (Julia Halperin, “Art of today dominates US museums”, The Art Newspaper, March 2017). Indeed, Contemporary creation reflects a much higher level of diversity than previous artistic periods, both in terms of origin and gender.

This greater diversity in the Contemporary Art sphere not only chimes with the interests of major public institutions, but also with those of corporate foundations, sponsors, curators and journalists, i.e… everyone who purchases, exhibits, writes about and rewards art. The Art Newspaper refers to this concordance of interests as a virtuous circle: “As more collectors focus on Contemporary Art, the composition of museums’ boards of trustees has shifted in this direction as well. “

This virtuous circle obviously has repercussions on the Market: prices changes in the Contemporary Art sphere can be faster and bigger than in any other segment.

Of course, Contemporary Art is not always profitable; an un-researched acquisition may end up losing value. That is why it is important for buyers to follow the evolution of each Contemporary artist closely. The financial potential in this sector is huge, but the risk factor is also high; like the financial markets… the stronger the growth, the higher the risk, particularly when growth gets into 3-digit percentages.

In any case, aside from the investment aspect, the Contemporary Art collector has the feeling of contributing to the History of Art; by endorsing a particular work or artist… by recognising its value, the collector takes a position and commits himself.

A bigger splash…

The $110.5 million spent on 18 May 2017 in New York for a canvas by Jean-Michel Basquiat epitomises the new dynamic driving the Contemporary Art market. Acquired by a Japanese collector aged 41, Yusaku Maezawa, Basquiat’s Untitled (1982) is now by far the most expensive work of Contemporary Art in the world. Its hammer price exceeded all the forecasts – those of Sotheby’s first of all – which guaranteed the sale to the tune of $60 million, and those of the buyer himself. In an interview conducted the day after the sale, Maezawa admitted: “I didn’t expect the price to go that high” .

*extracted from artprice’s contemporary art report 2017.