Art sales topped $63.7 billion in 2017, a 67 percent increase over 5 years. 75 percent of art collectors bought art for collecting purposes, but with an investment in mind—this figure is up a significant 53 percent from just a few years earlier.

Since collecting art can be an emotionally fulfilling hobby as well as a potentially lucrative investment, here are some tips that savvy art collectors know that you should keep in mind as you start to build your collection.

1. Collecting art is a process. Take your time.

While the phrase “buy what you love” gets tossed around all the time, it doesn’t mean you should buy on impulse or without doing your research. Part of the joy of collecting is the “courtship phase,” or what some might call the pursuit of getting to know an artist’s body of work and understanding the context within which the artist is working. It is also only through the process of looking that you hone your eye. Buying on impulse robs you of the opportunity to be discerning.

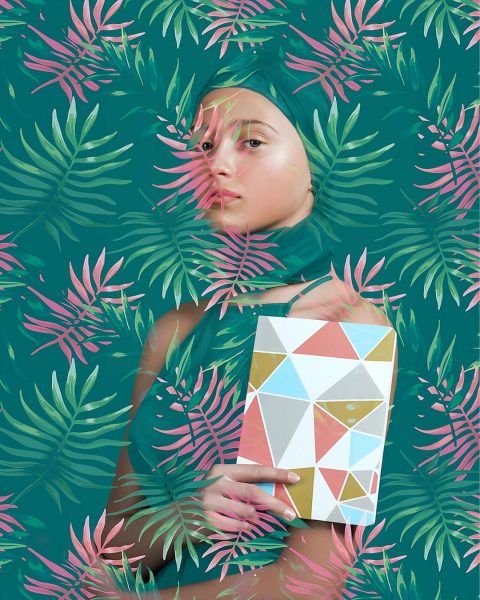

2. Buy with your eyes, not your ears. Buy what interests you and have a point of view.

Some art buyers are so caught up in what they hear is hot that they are buying other people’s tastes and then end up living with works they don’t like that they can’t get rid of. Also, many better known collections have a theme or focus. Collectors with a point of view often become known and sought after for their collections.

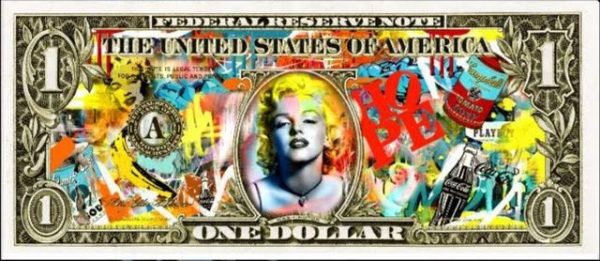

3. Understand the motivations of different players in the art market.

The art market has many constituents vying for attention. As such, the good artists with the bad are showcased with equal fervor. Auctions houses will always try to sell you what’s currently available, whether these things are right for you or not. So, it’s important to learn to take these motivations into consideration when you are thinking about buying or selling art.

4. Utilize experts.

Having a trusted expert can help you make sense of the market and of the prices. Art professionals with relevant experiences can steer you in the right direction or away from a costly mistake. Knowledgeable experts understand the cycles of the art market and can bring clarity to what oftentimes seems irrational to outside parties. They can ensure that you are getting value for your money.

5. The Art Market Is Diverse.

Prices for the same or similar items can vary widely among dealers and auction houses or between the two. It should never be assumed that one outlet’s price is correct and the other’s is wrong. There are collectors who over-pay for items and others think they are buying at a discount. The fact is, information isn’t always baked into the price as it may be in other markets.

6. Price doesn’t necessarily reflect value.

Determining value may be tricky and usually takes time. Just because an artist sells from a blue chip gallery or auction house at a high price doesn’t mean it will be worth anything down the road, for some of the reasons stated above. Auction houses are also now selling works by young unproven artists, giving buyers the false impression that these artists are here to stay. The truth is many of these artists are like the child stars of Hollywood; hot for a few years, but will then essentially disappear. The bottom line is, values for works are never “set.” They are constantly evolving in the marketplace depending on a myriad of factors including popularity, availability, art historical significance and rarity, among others.

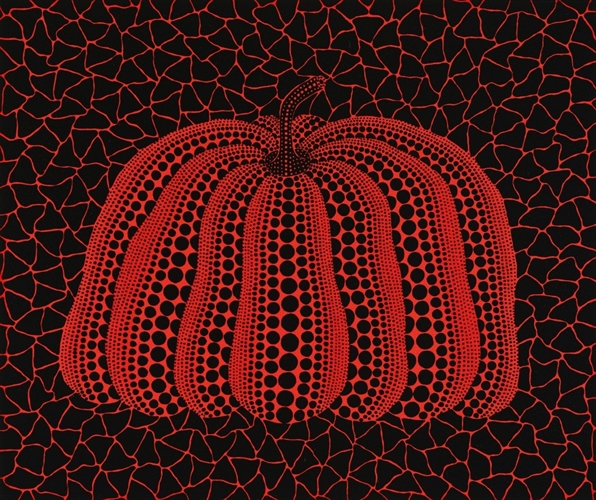

7. Quality retains and often increases in value.

Savvy buyers understand that a brand name can only take you so far and seek out “best-in-kind,” meaning they’d rather own a top work on paper by an artist than a third rate painting by the same artist, for example.

8. Art is an asset that needs to be managed.

True art collectors will tell you that they buy art as a passion, not as an investment. However, it is still an asset that needs to be overseen as you would any other valuable property. This means shipping, framing, insuring and storing it properly so as to avoid the risk of damage or loss. In addition, art can be used as collateral for loans or as part of a tax strategy, so it is important that your works are well kept and well documented.

9. Financial Rewards often accompany those who have invested emotionally in the process.

It’s like anything else in life: the more you put in, the more you get in return. Spend the time and do your homework, seek out experts, understand the market place, don’t get caught up in trends and you will build a collection that is both emotionally and financially rewarding.

*extracted from ellevate