These days, many long-term investors look to diversify their portfolios by investing in different, even exotic, asset classes. Some prefer to put their money in rare coins and jewels, while others invest in fine wines. One investment class quickly gaining in popularity is artwork. Not only can fine art enhance your home décor and evoke powerful emotions, it can appreciate in value simply by hanging on your living room wall.

The myths about investing in art have always kept the average person from entering this potentially lucrative venture. “I don’t know anything about art. Investing in art is only for the rich. What if I get ripped off?” These are all legitimate concerns, but they can be quickly broken down with a bit of research and knowledge.

Whether you want to buy into a fund, start your own collection, or just purchase a few pieces to decorate your home, the best thing you can do is educate yourself. The wonderful and profitable world of art may be right for you.

Types of Art

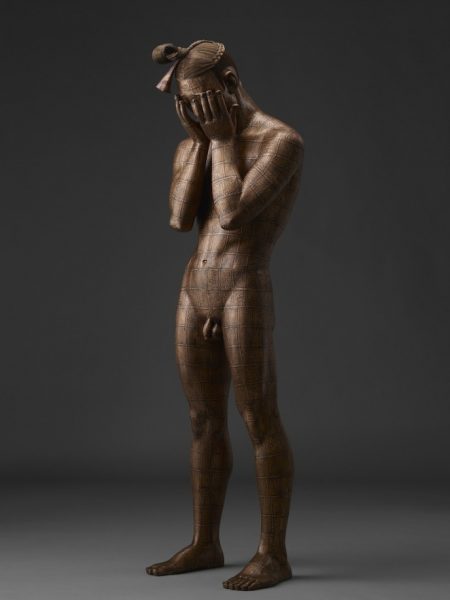

There are many types of art a new investor might explore. Novices tend to automatically think of paintings, but art spans a wide variety of media, styles, and classifications. Different types (or “disciplines”) include painting, drawing, photography, digital, mixed media, sculpture, prints, and even video.

Generally, production potters and glassblowers are not considered artists – there is nothing unique in the pieces they produce. Some, however, use these media exclusively to create unique works, have gained a certain amount of fame doing so, and are by and large considered artists.

Originals vs. Copies

Original works are the most highly valued pieces in the art world, but even a copy can be worth something. To know if your copy will appreciate in value, you have to be armed with certain knowledge.

• Originals. An original is a one-of-a-kind work of art. This is what most art investors purchase when speculating in the sector. Generally, it is the rarity of the original that justifies the high price.

• Prints. Even though a print is a copy, it is still considered a work of art and can have value. A print is produced through a variety of techniques, giving it a quality, clarity, and a visual impact that rivals the original. A word of caution, however: Some prints appreciate in value, but some do not. For example, limited edition prints are prints that the artist has agreed to run a finite amount of, say 50 or 100. Sometimes the artist autographs a print, which raises the value considerably.

• Reproductions. Posters, also known as reproductions, are copies of original works without a limited run of printing. These are great for art collectors on a budget, but are not worth much as far as investment value goes.

How to Buy Works of Art

Starting an art collection for investment purposes is a big step. Before you even think about what, where, or how to buy, you need to consider a few things if you want to maximize your upside.

First, make sure you do all your homework on the artist and style you’re targeting. Also, note the difference between the primary and secondary markets. Artwork being sold on the primary market means that it has never been seen or sold before, generating buzz among art enthusiasts. By contrast, the secondary market refers to artwork that has been sold before.

Generally, an artist with an interesting back story tends to generate more interest among buyers. Consider researching the artist’s age, education, previous exhibitions, and awards. You can usually find much of the information from the artist’s biography at the gallery where the works are displayed. For a more in-depth understanding of the artist, an online search can turn up quite a bit more.

Before you buy a piece for your collection, a thorough understanding of it is paramount. First on your list should be the question of its authenticity. Proving this is not difficult if the artist is still alive. However, if the artist is deceased, it can be problematic. The best way to protect yourself is to obtain a certificate of authenticity from an expert, preferably the foremost authority on the artist. Next on your list should be obtaining a thorough appraisal of the piece in question. If a work of art is damaged or substantially restored, it can affect its value greatly. Unfortunately, it is almost impossible to estimate the cost of a good appraisal. It depends on the piece, the period, the expertise of the appraiser, and other factors.

3. Investigate the Dealer

Whenever anyone buys a work of art, the reputation of the source should be open to extreme scrutiny. The confidentiality of the art market can make it very difficult to know the reputation of some dealers and brokers, especially the smaller ones. Researching the reputability of a gallery can be much easier. They feature their top artists, and information on past exhibits can be found on their websites and through word-of-mouth.

Be Cautious

Auction data and marketing hype are other traps to be wary of. The data that auctions provide can be skewed because the professional appraisal of a piece can vary depending on demand at the time of sale. Also, marketing hype is something prevalent in the art world, and first-time buyers are extremely susceptible. Judge each piece for its own merits.

Where to Buy Art

In many cases, the question of where to buy art can be as important as how to buy. Would you rather pay a set price, or would you enjoy bidding for a bargain at an auction? Is a small dealer who caters to individual tastes the better choice, or should you browse the galleries? The answers depend on your objectives, and they could make a big difference in price.

An auction is an exciting place to be, especially when two or more bidders want the same piece – but make sure not to let the ego gets in the way and get caught up in the moment. If you want a piece because you truly love it, a higher price may be justified. However, if you are a collector or investor, be sure to weigh price, value, and condition, and adjust your bid accordingly. Professional art investors try to completely cut out emotion and proceed with a calculating, business-like demeanor.

Also, keep in mind that when you purchase art at an auction, the “hammer” price is not the full price you pay. Anywhere between 10% and 30% can be added to your final bid. This is known as a buyer’s premium, and it depends on a variety of factors including price and provenance of the work, plus additional administrative costs such as shipping and delivery.

Compared to an auction, a gallery is a much more relaxed environment to view, evaluate, and decide on your purchases. The majority do not charge a buyer’s premium, so the amount on the price tag is close to what you eventually pay. Some galleries focus mainly on the primary market, dealing with newer artists. Other galleries tend to focus on the secondary market, reselling artwork without necessarily having any ties to the artists themselves.

Many galleries do both. However, you should know what a gallery’s particular slant is before you walk through the doors. Art galleries are also unique in that they frequently work with artists, helping them grow, building up an inventory of their work, and assisting them as they try to realize their potential.

A fair can be a good place for the novice to develop an eye for art. There is something for everyone, no matter their level of expertise. At art fairs you can browse, mingle with other art lovers, ask questions of the experts, compare prices, and evaluate. And, some of the offerings can rival works sold at prestigious galleries and auctions.

Investing in Art: The Advantages

- Physical Asset. A big plus for many investors is the fact that you control the asset. It is in your care, not in the hands of an investment firm. Many people have a hard time trusting others with their investments, especially when wrongdoings and SEC investigations consistently make front page news. An art investment is all yours – the management, care, and storage are your responsibility.

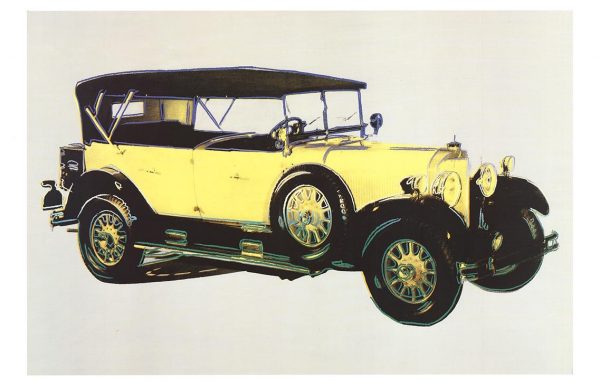

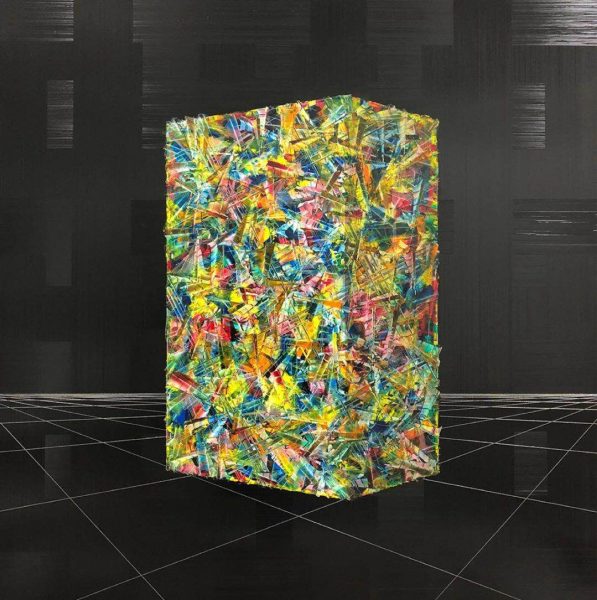

Andre Nadal, ‘BCM141217’ 2. Enjoyment Value. Many art investors are collectors first and investors second. Fine art is an asset that can be displayed and appreciated. As a matter of fact, if you’re not interested in art whatsoever, this could be a difficult or tedious investment for you to initiate.

3. Appreciates Over Time. Unlike stocks, whose underlying companies reflect a volatile price, art usually appreciates steadily with time. If you have chosen the pieces in your collection wisely, sometime down the road your art is likely to be worth considerably more than what you paid for it.

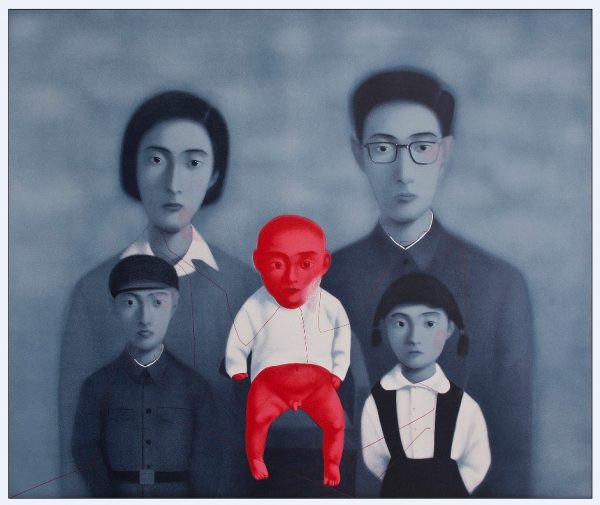

Liu Hong, ‘Lip Language’ 4. No Market Fluctuations. We all know what a roller coaster ride financial markets can be. However, stock market corrections, volatility, and other financial fluctuations are nonexistent in the art world. This is seen as one of the biggest advantages to investing in art. The collector can sleep peacefully at night, without the worries that plague other investors.

Caring for Your Art

Many of the following tips are common sense precautions, but there are some very real do’s and don’ts that should be followed to ensure the preservation of your collection.

Handling

Before handling your works of art, make sure your hands are clean and dry, and remove any jewelry. It is also a good idea to handle only one piece at a time, rather than to carry a stack of paintings all together. Pick up a painting firmly from both sides of the frame, avoiding the painted surfaces. If you pick it up from the top of the frame, you’re putting the entire weight of the piece on the area you’ve grasped. This could cause the canvas to stretch or tear.

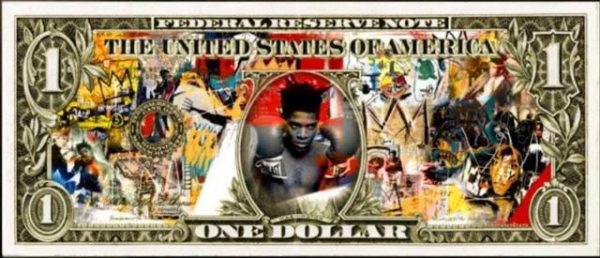

DAVID DAVID, ‘Head in Art’

Use a soft, natural-hair brush to dust – something easy to work with, but not too small. Without applying any pressure, first brush in one direction completely. Then repeat in another direction until fully dusted. Do not dust if the paint is cracked or flaking. In addition, the environment where a painting is displayed can lead to dust and dirt accumulating, thus degrading the image. Be sure to store it in a dry place of moderate temperature. If significant cleaning is called for, hire a professional to evaluate and do the job, and never use any chemical or ordinary kitchen cleaners. Remember, the pieces in your collection may be worth a fortune in the future, and the slightest bit of damage can have a significant impact on their value.

When storing your collection, keep it out of direct sunlight, away from damp areas such as cellars and basements, and far from heat sources such as fireplaces and boilers. The more you can shield artwork from frequent and harsh temperature swings, the better. Also, the best way to store multiple paintings for long periods at a time is in a painting rack. This can prevent physical contact among the paintings, greatly reducing the chances of damage.

Final Word

For many folks, the world of art is not just a hobby or investment – it is a passion. It’s a way to open a door and lose yourself in beautiful works from different countries, different disciplines, and different times. Many enthusiasts regard art as a historical record of humankind, so open the door and begin your wonderful journey.