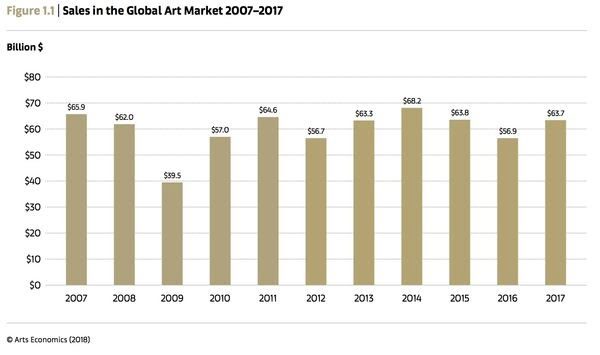

We’re living in the golden era of unevenly distributed global wealth creation, which, for the art market, means business is booming. As the economist Clare McAndrew outlines in The Art Market | 2018, released by UBS and Art Basel, the global art economy grew for the first time since 2014 with $63.7 billion in total global sales, a rise of 12% from 2016.

The 2018 edition of the annual study is a 347-page exploration of a market that’s finally rising after two straight years of decline. McAndrew’s findings provide fascinating insight into how the explosion of global wealth has allowed the top end of the market to carry the industry toward new heights, even as mid-level sectors struggle to keep up.

“In 2017, despite remaining political volatility in many regions, robust growth in global wealth, particularly at the high end, improved economic performance, accelerating financial market returns, stronger consumer confidence and increased supply led to a much more favorable environment for sales,” McAndrew writes in the report.

To research her findings, McAndrew’s research firm Arts Economics conducted a survey of 6,500 dealers from various parts of the world—though only 14%, or about 910 dealers, actually responded, underscoring the difficulty in extracting data from the heart of the art market. There was support from dealers’ associations and interviews with dealers from different sectors, but no names are divulged, and it’s unclear how many came from prominent galleries.

McAndrew also used auction data from resources such as Auction Club, and the Art Market Monitor of Artron (AMMA)’s database of 5.6 million auction results in China. She and UBS also conducted a survey of thousands of wealthy individuals to ascertain habits of art collectors, and she used as secondary sources reports compiled by Merrill Lynch, Credit Suisse, and the IMF World Economic Outlook.

The figures can make one woozy. The combined wealth of High Net Worth Individuals (HNWIs)—that is, anyone with more than $1 million in the bank—is a staggering $63.5 trillion, the highest point in world history, and is up nearly 50% from 2010.

And many have wall space they’re looking to fill: Arts Economics teamed with UBS to survey 2,245 American millionaires and billionaires (the kinds of people who don’t usually like to fill out surveys), and found that 35% of them collected art and antiques in 2017.

Right off the bat, there’s confirmation of what we all suspected: The art market is back. The global art bazaar brought in total sales of $63.7 billion in 2017, which is up from what was reported as a $56.6 billion haul in last year’s report (though that figure has been revised in the new report and listed as $56.9 billion, an upward revision of $300 million). However, it has yet to recover back to the level of sales in 2014, which reached $68.2 billion. Of the major areas for selling art, the auction sector saw the biggest boost as sales rose 27%, following a dip of a similar magnitude in 2016—last year’s report indicated that auction sales had dropped 31%. Auction sale growth was largely due to a handful of works at the very high end. Sales of work at more than $10 million exploded in 2017, increasing by 125%.

And while only 0.2% of artists have work that sells for more than $10 million, such sales accounted for 32% of all sales by value.

Post-war and contemporary was the largest of the auction sectors in 2017, with a 46% share of the market by sales, as it has been every year since 2011. It is followed by modern art, which accounts for 27% of sales, up from 23% in 2016. European Old Masters have, since the rise of the contemporary and modern sectors in the late 2000s, been a small enough sector of the market (7% in 2017, roughly steady over the past 10 years) that an entire year’s worth of auctions can be shaken up by a single cannonball of a sale: The $450 million Leonardo da Vinci painting that sold last November at Christie’s helped boost the sector by 64%; without it, sales of European Old Masters would have been down 11% year-over-year.

In the dealer sales sector, which accounted for 53% of sales by value in 2017, overall sales rose by 4% year-over-year, but the growth was unevenly distributed. Dealers who had sales of more than $50 million over the course of the year said their businesses rose 10%.

Asia reigns supreme

The number of billionaires in Asia is rising faster than anywhere in the world—in 2010, it had 24% of the world’s share, and now it has 41%, more than North America (at 33%) and Europe (at 21%).

China is manufacturing these billionaires at nearly the clip at which it turns out sneakers and iPhones. The country had 26% of the world’s billionaires in 2017, up from 6% in 2010. Thanks to a robust slice of global auction sales—33%, right behind the United States’s 35%—China accounted for 21% of global art market sales to seize second place, edging out the United Kingdom, which had 20% of global art sales in 2017. McAndrew thinks that the market could increase there in lock step with wealth expansion. According to Arts Economics’s findings using data from Credit Suisse, the next five years will bring approximately 205 new Chinese billionaires, over twice as many as expected from all of Europe.

The vast majority of collectors interviewed say “I’ve never sold a work”

No one wants to admit to being a flipper. Of the 791 active art buyers who were interviewed in the Arts Economics/UBS survey, a whopping 86% claim to have never once sold a work from their collection.

A separate UBS survey of HNWIs, referred to in the report, found that “40% could not estimate the value of their own collection and the majority had not discussed their collections with a financial advisor,” and that “the vast majority (81%) [was] planning to leave their collections to their heirs when they passed away.”

The total sales in the art industry are still dwarfed by big tech…for now

At one point, McAndrew reminds us that Google alone generated $110 billion in revenue in 2017, making the $63.7 billion generated by approximately 310,685 different businesses in the art world seem a bit paltry. But look for that number to increase as wealthy people get wealthier. “By 2025, forecasts are that [the combined wealth of all HNWIs] may reach as high as $106 trillion,”

McAndrew writes. “If as low a portion as 0.1% of that increase in investable wealth were to be invested in works of art over the eight-year period, this alone could add a further $40 billion to art sales, bringing the market well in excess of $100 billion.”

*extracted from artsy